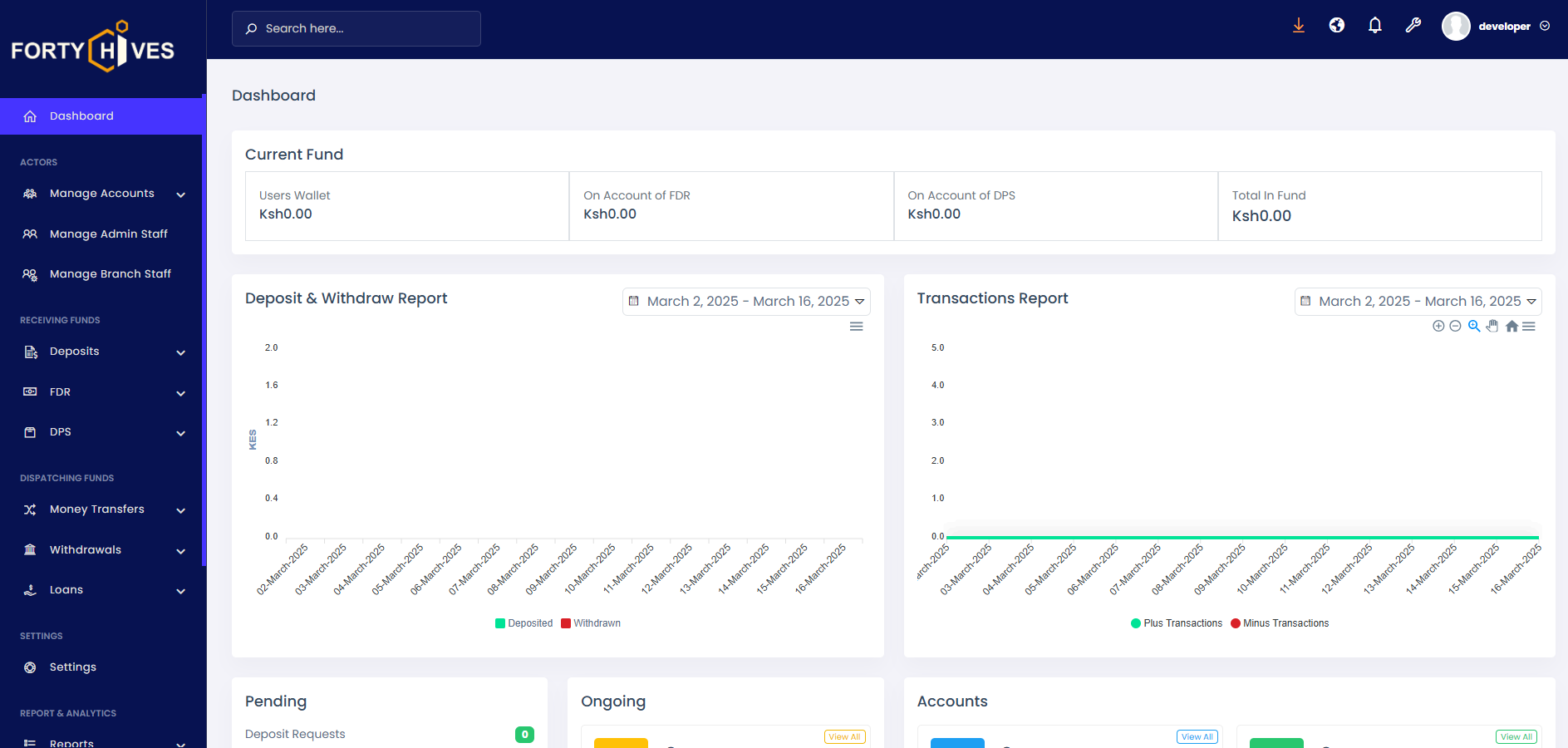

Digital Banking System

FortyHives Digital Banking System is a secure and scalable digital banking system tailored for Kenyan financial institutions, fintech startups, and businesses. It offers features such as multi-currency support, secure transactions, automated banking processes, KYC verification, and seamless fund transfers to enhance digital banking experiences.

Experience the full functionality—no signup required.

Jump right in and explore all the features our platform has to offer. Whether you're evaluating for your team or just curious, the demo environment is fully unlocked so you can see how everything works in real-time. Test workflows, navigate dashboards, and see the value for yourself—no commitments, no barriers.

Admin

Username:

demo@fortyhives.com

Password:

Demo-123!

User

Username:

user@fortyhives.com

Password:

User-123!